The Malaysian government has mandated the implementation of electronic invoicing (e-Invoicing) as part of its digital transformation efforts to enhance tax compliance and streamline business operations. The Lembaga Hasil Dalam Negeri (LHDN) has introduced the MyInvois system to facilitate the real-time submission and validation of e-Invoices.

For small businesses : Solopreneurs, micro-businesses, small and medium-sized enterprises (SME), adapting to this new regulation might seem challenging. However, with the right solution, businesses can achieve MyInvois compliance quickly and efficiently. ASSIST.biz offers seamless integration with existing invoicing workflows, ensuring automated submission to LHDN with minimal disruption to your business processes.

This guide explains the e-Invoicing process and how small companies in Malaysia can become MyInvois-compliant in less than a week using ASSIST.biz.

Understanding the e-Invoicing Process

What is e-Invoicing?

Electronic invoicing (e-Invoicing) is a digital method of issuing and receiving invoices in a structured format that allows for automated processing. Unlike traditional paper-based or PDF invoices, e-Invoices follow a standardized format that enables real-time validation and automated tax reporting.

The e-Invoicing Workflow

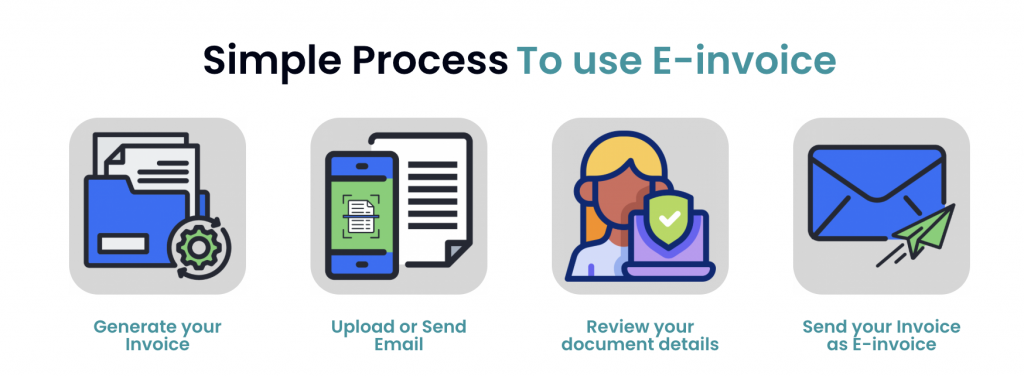

The MyInvois system follows a structured process for e-Invoicing:

Step 1: Invoice Generation

The seller generates an invoice using their invoicing or accounting system in a format that complies with LHDN’s e-Invoice standards.

Step 2: Submission to LHDN

The invoice is submitted electronically to LHDN’s MyInvois system for validation and approval.

Step 3: Validation & Approval

LHDN verifies the invoice details, ensuring compliance with tax regulations. Once validated, a Unique Identification Number (UIN) is assigned to the invoice.

Step 4: Delivery to Buyer

After approval, the seller delivers the e-Invoice to the buyer, along with the UIN, ensuring authenticity and compliance.

Step 5: Automated Tax Reporting

The approved e-Invoice data is automatically recorded in LHDN’s system for tax reporting, reducing the need for manual tax filing.

Get MyInvois-Compliant in Less Than a Week with ASSIST.biz

How ASSIST.biz Simplifies e-Invoicing for small businesses

ASSIST.biz is a powerful cloud-based invoicing and business management solution designed for small firms, as well as large enterprises, in Malaysia. Our platform integrates effortlessly with existing invoicing processes, automating the submission of e-Invoices to LHDN’s MyInvois portal.

Here’s how ASSIST.biz can help your business become MyInvois-compliant in less than a week:

1. Quick and Easy Integration

- Works with both paper & digital invoices.

Even if you are using manual Excel and Word document templates to prepare pdf invoices, it works !

- No changes to your existing finance workflow—keep doing what works for you.

- No accounting software necessary

- No need for costly system upgrades

2. Automated Invoice Submission

- Email or upload your invoice to ASSIST.biz

- It automatically converts your current invoices/billing template into MyInvois-compliant e-invoice format.

- Submits invoices directly to LHDN for validation.

- Retrieves and attaches the UIN from LHDN before sending invoices to buyers.

3. Saves Time & Reduces Manual Work

- Eliminates manual data entry at MyInvois portal

4. Secure & Cloud-Based

- Accessible from anywhere, anytime.

- Secure data storage with automatic backups.

- Can use ASSIST.biz as retention storage of digital invoices for at least seven years, to comply with tax audit requirements.

Conclusion: Future-Proof Your Business with e-Invoicing

The transition to e-Invoicing is not just a regulatory requirement but also a business opportunity. SMEs that embrace automation and digital transformation will benefit from greater efficiency, accuracy, and compliance.

With ASSIST.biz, your small business can become MyInvois-compliant in less than a week—without disrupting your operations. Our cost effective solution makes it easy to integrate, automate, and comply with Malaysia’s e-Invoicing regulations.

Don’t wait until the last minute! Start your e-Invoicing journey today with ASSIST.biz and stay ahead of the curve.

Get Started Now!

Sign up for ASSIST.biz and automate your e-Invoicing process today!

Frequently Asked Questions (FAQ)

What is MyInvois e-Invoicing?

MyInvois e-Invoicing is Malaysia’s government-mandated system for electronic invoicing. It ensures real-time validation and automated tax reporting via LHDN.

Who needs to comply with MyInvois e-Invoicing?

All businesses in Malaysia, including solopreneurs, micro-businesses, and SMEs, must adopt e-Invoicing to comply with LHDN regulations.

How does MyInvois e-Invoicing work?

- Generate an invoice using your system.

- Submit it to LHDN’s MyInvois portal.

- LHDN validates and assigns a Unique Identification Number (UIN).

- The invoice is sent to the buyer with the UIN.

- Data is automatically recorded for tax reporting.

Do I need new accounting software for e-Invoicing?

No! With ASSIST.biz, you can continue using your current invoicing method (Excel, Word, or other tools) without changing your finance workflow.

How can ASSIST.biz help with MyInvois compliance?

ASSIST.biz automates invoice submission to LHDN, eliminating manual entry and ensuring compliance with minimal effort.

How long does it take to become MyInvois-compliant?

With ASSIST.biz, you can get compliant in less than a week without disrupting your existing processes.

Is MyInvois e-Invoicing secure?

Yes! ASSIST.biz provides secure, cloud-based storage with automatic backups, ensuring compliance with tax audit requirements.

How do I get started with ASSIST.biz?

Simply sign up for ASSIST.biz today and start automating your e-Invoicing process hassle-free!

Recent Comments