In today’s fast-paced digital landscape, businesses across the globe are reimagining their processes to gain efficiency and remain compliant. One of the most significant evolutions in finance and accounting is e-invoicing—the electronic exchange of invoices between suppliers and buyers. Once considered a “nice-to-have” convenience, e-invoicing has become crucial for organizations aiming to streamline operations and meet emerging global mandates.

However, despite its undeniable advantages, transitioning to e-invoicing is rarely an overnight process. Many companies still rely on paper-based or PDF invoice workflows—and striking the right balance between traditional and digital solutions is where a hybrid approach comes into play.

In this blog post, we’ll explore what global e-invoicing is all about, why it matters, and how adopting a mixed (paper + digital) strategy can smooth the transition for businesses worldwide.

What Is E-Invoicing?

E-invoicing refers to the creation, exchange, and processing of invoices in a structured digital format—often XML or EDI (Electronic Data Interchange). Unlike paper or PDF invoices, an e-invoice is transmitted directly from the supplier’s system to the buyer’s system, often via a secure network or platform. This automation cuts out manual data entry and greatly reduces the chance of human error.

Key Features

- Standardized Format: E-invoices adhere to government or industry-based formats for ease of interchange and validation.

- Real-Time Transmission: Invoices can be sent and received instantly, cutting down waiting times.

- Automated Processing: Data extraction, validation, and payment approvals can be mostly automated, saving time for finance teams.

The Importance of E-Invoicing—and Why Paper Still Remains

E-Invoicing Advantages

- Efficiency Gains

By automating the invoice exchange and approval process, businesses free their finance teams from manual data entry and error handling. - Enhanced Cash Flow Management

Faster turnaround and real-time visibility into invoice status can improve cash flow, enabling better negotiation for payment terms and discounts. - Compliance and Tax Transparency

Many countries have introduced strict e-invoicing mandates. An electronic system helps companies stay compliant with local laws and avoid penalties. - Data Accuracy

E-invoicing significantly reduces the risk of manual errors or lost documents. - Environmental Benefits

Reducing paper usage contributes to an eco-friendlier business model, aligning with CSR goals.

Why Paper-Based Processes Still Exist

Despite these benefits, many organizations continue to rely on manual or paper-based processes. Common reasons include:

- Legacy Systems: Some companies use older IT systems that aren’t readily compatible with new digital solutions.

- Complex Supply Chains: Businesses dealing with multiple suppliers or clients may face challenges if those partners are not yet ready for digital invoicing.

- Regulatory Nuances: While e-invoicing mandates are rising, not all countries have uniform regulations, and some industries still permit or require paper documentation.

- Change Management: Transitioning to e-invoicing can be disruptive. Training staff and overhauling existing workflows may take longer than anticipated, making a 100% digital shift challenging.

The Hybrid Approach: Bridging Paper and Digital

Given the various reasons paper persists, a hybrid invoicing model often serves as a practical stepping stone. Under this model, businesses can gradually phase out paper invoices while introducing e-invoicing for specific partners or processes.

Key Benefits of a Hybrid Approach

- Flexibility: Supports different invoice formats—paper, PDF, and e-invoice—based on what each partner or regulatory environment requires.

- Reduced Disruptions: Allows you to adopt e-invoicing incrementally, minimizing resistance from teams that are used to paper-based processes.

- Controlled Costs: Large-scale system overhauls can be expensive. By going hybrid, you can invest in digital technology only where it makes immediate sense and expand gradually.

- Smoother Onboarding: Partners who are not yet ready for full-fledged e-invoicing can continue with paper, ensuring business continuity as you grow your digital capabilities.

Global Trends and Regulatory Landscape

Latam (Latin America)

Latin America has been a frontrunner in e-invoicing. Brazil and Mexico have strict mandates, ensuring high adoption rates. However, smaller businesses or external international partners may still prefer paper due to resource or technology constraints.

Europe

The European Union implements various e-invoicing standards (e.g., PEPPOL), initially focused on public procurement. Countries like Italy have gone further, mandating e-invoicing for B2B transactions. Yet, even in these regions, paper-based invoices may still appear when dealing with certain foreign vendors or smaller operations.

Asia-Pacific

Countries like India have moved toward mandatory e-invoicing for specific turnover thresholds. Others, such as Australia, Singapore, and Japan, have introduced frameworks that encourage (but do not always mandate) e-invoicing. In all cases, businesses often rely on a mix of digital and paper workflows as they adapt to changing rules.

North America

There’s no uniform federal mandate in the U.S. for e-invoicing, though corporate policies and cost-saving measures are driving adoption. Canada is integrating e-invoicing in public procurement via PEPPOL, and businesses are gradually following suit. Nonetheless, paper-based processes remain prevalent, especially in smaller organizations.

How to Prepare for a Hybrid E-Invoicing Model

1. Assess Current Systems

Take inventory of your invoicing processes. Which tasks can be digitized right away? Where do you still need paper due to partner requirements or technical limitations?

2. Choose a Flexible Platform

Select a solution that can handle both e-invoices and paper-based workflows. It should convert paper or PDF invoices into electronic formats for streamlined processing, while also supporting local regulatory mandates.

3. Encourage Partner Adoption

Start with the suppliers or customers most ready for e-invoicing. Demonstrate how automation reduces errors and speeds up payments—success stories will encourage others to get on board.

4. Provide Adequate Training

Change can be challenging. Offer hands-on training and clear guidelines so employees understand how to process both paper and digital invoices within the same system.

5. Maintain Compliance

Monitor relevant regulations in each market where you operate. Make sure your hybrid system can adapt to shifting rules—especially when e-invoicing becomes mandatory in a new region.

Overcoming Common Hybrid Challenges

• Multiple Formats to Manage

Handling paper, PDF, and XML invoices simultaneously can be complex. Consolidating all invoices in a single digital repository (via scanning or data capture tools) eases this burden.

• Data Security

E-invoicing solutions must ensure secure data transmission. For paper documents, implement strict protocols to maintain confidentiality (locked storage, controlled access, etc.).

• System Integration

Ensure that the chosen hybrid platform integrates with your existing ERP or accounting system. This prevents data silos and keeps financial information up-to-date in real time.

• Workflow Coordination

Clear workflows and responsibilities are essential. Define who processes paper invoices, who handles digital entries, and how all data is eventually consolidated.

The Road Ahead: Transitioning to Fully Digital

While a hybrid model offers a practical way to bridge the gap, the ultimate goal for most companies remains a fully digital, automated invoicing workflow. Over time, as regulatory requirements tighten and business partners adopt modern solutions, the reliance on paper should diminish. Adopting a hybrid approach now lays the foundation for smoother, more cost-effective evolution to full e-invoicing in the future.

Long-Term Benefits of Full E-Invoicing

- Faster payment cycles and reduced processing times

- Enhanced compliance and real-time audit-readiness

- Minimal paper use, aligning with sustainability goals

- Scalable solutions for growing, globally distributed teams

Final Thoughts

E-invoicing is not an all-or-nothing endeavor. Many businesses find that a hybrid approach—where paper and digital workflows coexist—is the most feasible path forward in the near term. This strategy respects the realities of legacy systems, varied partner readiness, and multiple regulatory frameworks.

By carefully assessing your operations, choosing a flexible platform, and gradually increasing digital adoption, your organization can enjoy the benefits of e-invoicing while minimizing disruptions. And when you’re ready to go fully digital, you’ll already have a solid, proven infrastructure in place.

Ready to explore a hybrid e-invoicing solution? Contact us at assist.biz to learn how our platform can help you seamlessly blend paper-based and digital invoicing. Let’s work together to modernize your financial operations, step by step, in a way that meets your business needs today—while preparing for the opportunities of tomorrow!

Frequently Asked Questions (FAQ)

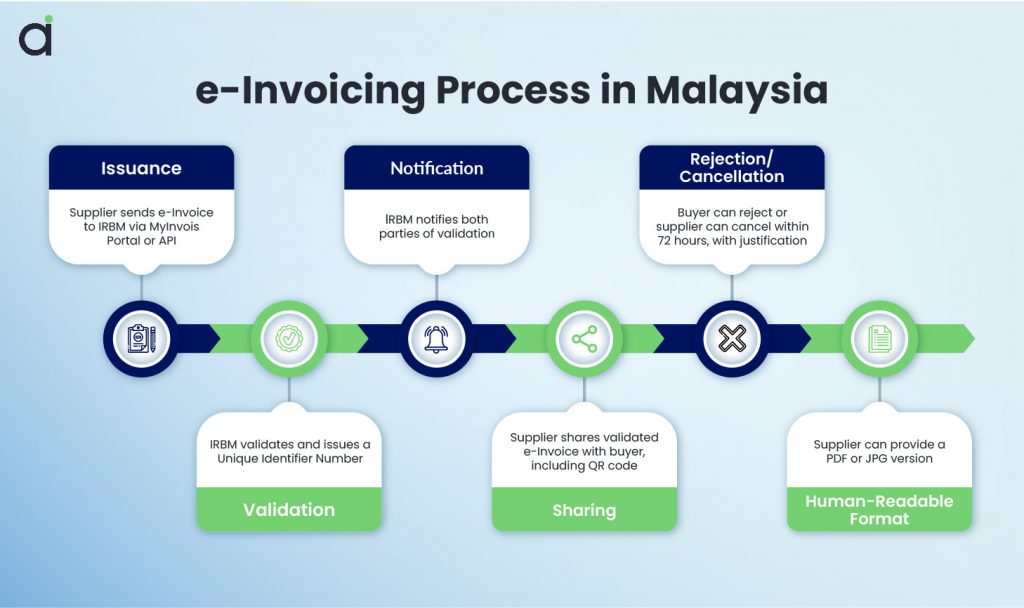

What is e-invoicing, and how does it work in Malaysia?

E-invoicing in Malaysia refers to the digital exchange of invoices between businesses and the tax authority (LHDN) using a structured format. The country is adopting the Peppol framework to standardize e-invoicing, ensuring compliance and efficiency.

Is e-invoicing mandatory for all businesses in Malaysia?

Yes, Malaysia is gradually implementing e-invoicing mandates. Large businesses are required to comply first, with a full rollout expected over the coming years. Companies should stay updated on LHDN guidelines to ensure timely adoption.

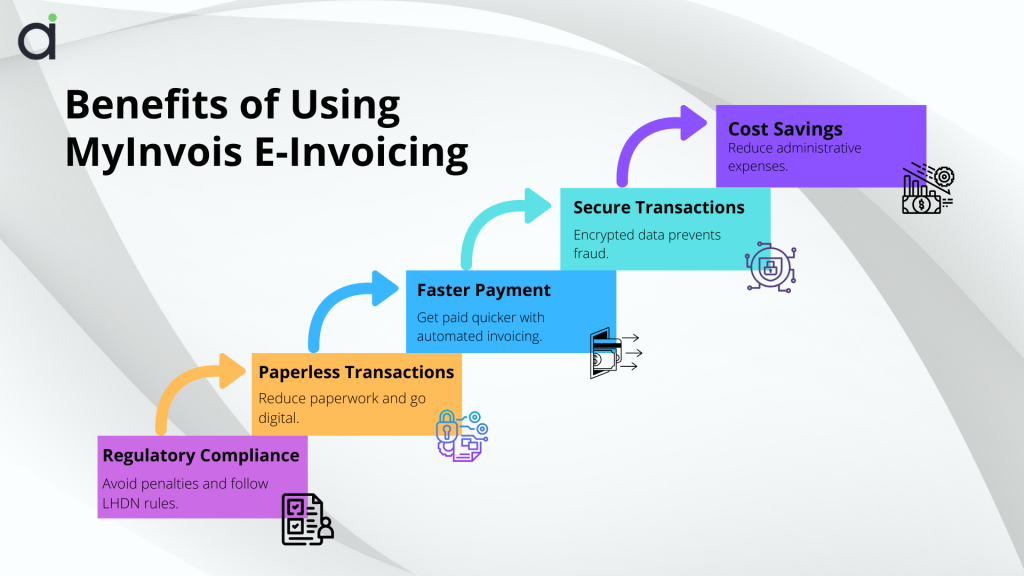

What are the benefits of using e-invoicing over traditional invoicing?

E-invoicing reduces processing time, improves cash flow, minimizes errors, enhances compliance, and supports environmental sustainability by cutting paper usage.

How can small businesses transition to e-invoicing?

Small businesses can start by adopting a hybrid model, using both paper and digital invoices. Choosing an e-invoicing platform that integrates with existing accounting software can ease the transition.

Can I still use paper invoices if my partners are not ready for e-invoicing?

Yes, businesses can operate with a hybrid model, where both paper and digital invoices coexist until all partners are fully transitioned to e-invoicing.

What are the key challenges of implementing a hybrid invoicing model?

Challenges include managing multiple invoice formats, ensuring data security, integrating with existing ERP systems, and training staff on new workflows.

Recent Comments