Running a small business or working as a solopreneur comes with enough challenges—chasing payments shouldn’t be one of them. If you’re still relying on paper invoices, PDFs, or spreadsheets, it’s time to consider e-invoicing.

By adopting e-invoicing for solopreneurs & SME, it can streamline cash flow, reduce admin work, and ensure compliance with government regulations. In this guide, we’ll break down what e-invoicing is, why it matters, and how you can make the transition smoothly.

What is E-Invoicing?

E-invoicing is the process of creating, sending, and receiving invoices in a structured digital format — usually XML or JSON — rather than PDFs or paper. Unlike email-based invoices, true e-invoices integrate directly with accounting software and tax authorities, ensuring faster processing and compliance.

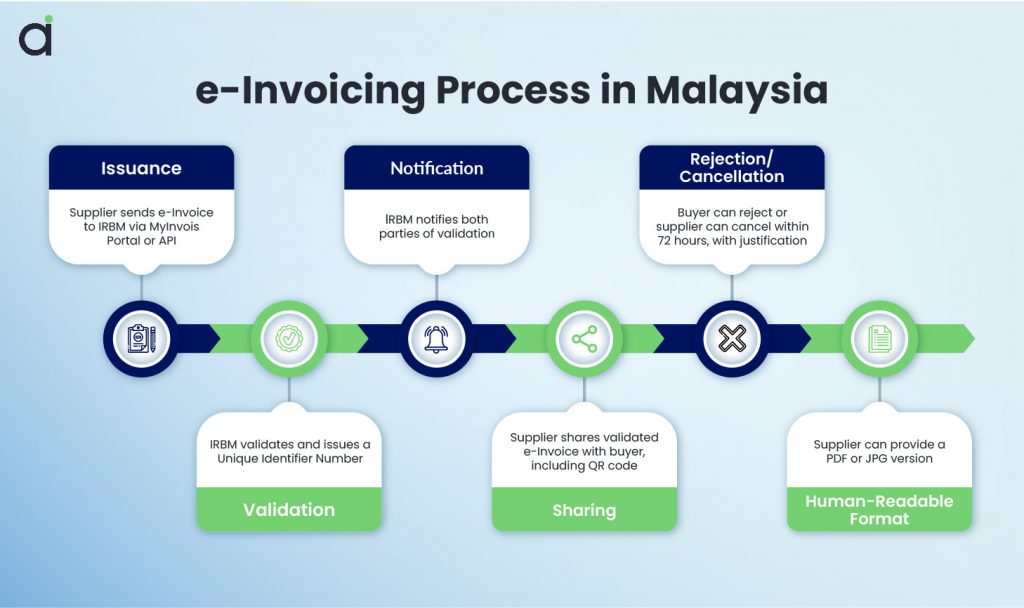

Governments worldwide are mandating e-invoicing to improve tax transparency and automate transactions. For example, Malaysia’s e-invoicing rollout is set to impact businesses of all sizes, including SMEs.

Why Solopreneurs & SMEs Should Adopt E-Invoicing

1. Faster Payments, Better Cash Flow

Late payments are a common problem for small businesses. E-invoicing reduces payment delays by:

- Automating invoice delivery to clients

Sending real-time tracking and reminders

Integrating with e-payment gateways for instant transactions

2. Less Admin Work, More Time to Grow

Instead of manually creating invoices and following up on payments, e-invoicing software:

Auto-generates invoices from sales transactions

Syncs with accounting software like Xero or QuickBooks

Eliminates data entry errors, saving hours of work

3. Cost Savings on Paper & Processing

Printing, mailing, and storing paper invoices add unnecessary costs. E-invoicing:

Cuts printing & storage costs

Reduces admin time spent on tracking and reconciliation

Lowers the risk of lost invoices or disputes

4. Compliance & Tax Readiness

Many governments now require businesses to issue e-invoices to comply with tax regulations. Being ready for e-invoicing ensures:

No penalties or fines for non-compliance

Seamless integration with tax reporting systems

Easier auditing and tax filing

How to Get Started with E-Invoicing

Step 1: Choose an E-Invoicing Solution

Look for a platform that integrates with your current accounting tools, supports government compliance, and automates invoice tracking.

Step 2: Digitize Your Invoice Process

Upload customer details, set up invoice templates, and connect your system to an e-payment gateway.

Step 3: Ensure Compliance with Regulations

Check your country’s e-invoicing guidelines and confirm that your software provider meets legal requirements.

Step 4: Educate Your Clients & Partners

Let customers know you’re transitioning to e-invoicing, and ensure they can receive invoices in the required format.

Final Thoughts: Future-Proof Your Business

The shift to e-Invoicing is not just about compliance—it’s a game-changer for solopreneurs and SMEs. By automating and streamlining invoicing, businesses can save time, reduce costs, improve cash flow, and enhance professionalism.

Ready to make the switch? Explore how Assist.biz can help you simplify e-invoicing and focus on growing your business. 🚀

FAQ: Frequently Asked Questions About E-Invoicing

What is the difference between e-invoicing and digital invoicing?

E-invoicing refers to structured invoices that integrate with accounting software and tax authorities, while digital invoicing includes PDFs or emailed invoices that require manual processing.

How does e-invoicing help with tax compliance?

E-invoicing ensures that invoices are automatically reported to tax authorities, reducing errors and making audits easier.

What software do I need for e-invoicing?

You need an e-invoicing platform that integrates with your accounting software and meets government compliance standards.

Can solopreneurs benefit from e-invoicing?

Yes! Solopreneurs can use e-invoicing to automate payments, track invoices, and get paid faster with minimal administrative work.

How secure is e-invoicing?

E-invoicing platforms use encryption and secure networks to ensure that your financial data is protected from fraud and cyber threats.

How do I transition to e-invoicing smoothly?

Start by choosing a compliant e-invoicing solution, digitizing your invoicing process, ensuring compliance, and informing your clients about the switch.

Recent Comments