The business world is changing so rapidly that e-invoicing has taken it in its wholeheartedly. As a solopreneur, going for e-invoicing is very important in keeping up to date with the competition, streamlining operations, and following coded tax regulations. It is important that independent business owners, consultants, and freelancers become familiar with e-invoicing standards.

What Is E-Invoicing?

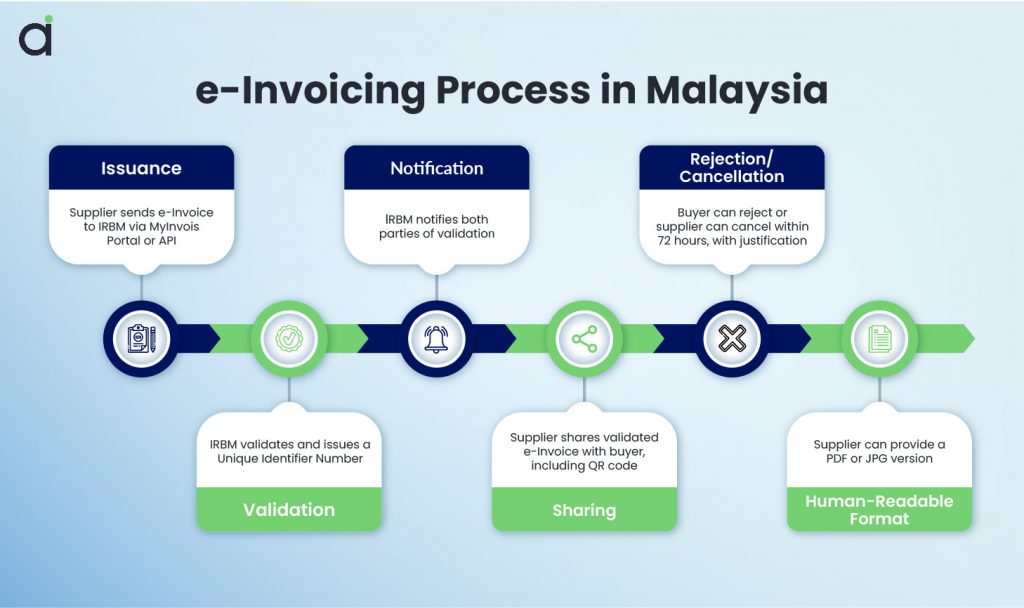

E-invoicing means using electronic means to create and exchange invoices for storage and compliance purposes. E-invoicing is more efficient, secure, and environment-friendly compared to paper invoicing. Many jurisdictions, Malaysia being one of them, have made it mandatory to use e-invoicing in order to improve transparency and fight tax fraud.

Why Solopreneurs Should Care About E-Invoicing

The limited resources and time of a solopreneur mean spending a lot of time manually managing invoices, risking human error. E-Invoicing automates this process, thus reducing workload and chances of human error. It also helps to comply with tax by securing the invoices for easy access in auditing.

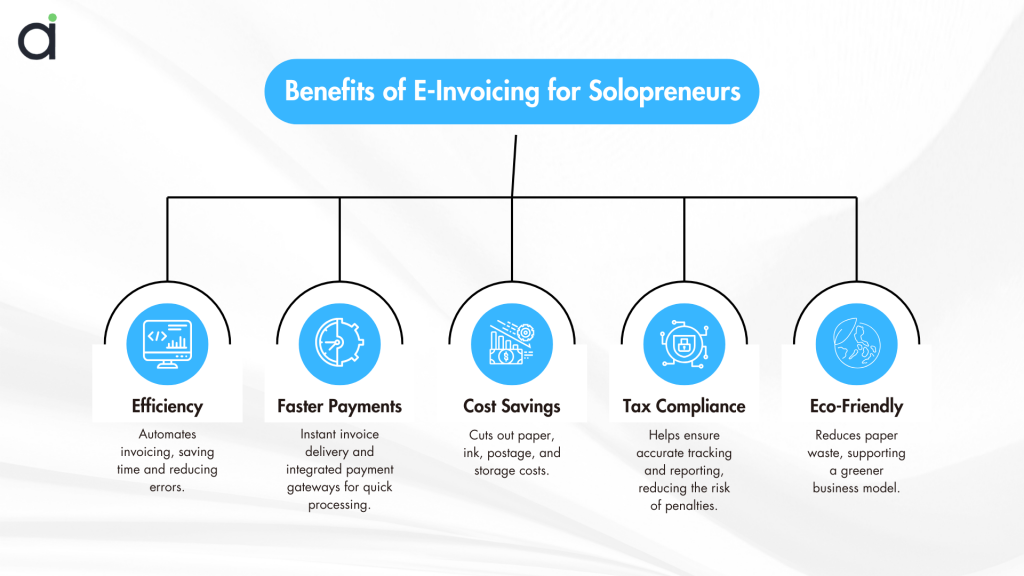

Key Benefits of E-Invoicing for Solopreneurs

1. Increased Efficiency

The process of e-invoicing removes printing, dispatching, and manual data entry. In simple terms, this automation should allow solopreneurs to concentrate on business growth by streamlining transactions.

2. Immediate Payments

Because digital invoices can be delivered immediately, payment processing becomes really fast. Its other features: many e-invoicing systems include payment gateways that allow clients to pay immediately, minimizing delays.

3. Cost-Efficiency

Compared to traditional invoicing, expenditures incurred that include paper, ink, postage, and storage will take place. E-invoicing cuts out those expenses so solopreneurs can be economical.

4. Safer Tax Compliance

Avoidance of tax-related problems in e-invoicing is based on tracking and reporting accuracy. This limits error possibilities and cuts down penalties.

5. Advantages to the Environment

Going for digital invoicing lessens the waste of paper that would make the world go round, which is eco-friendly for such a business, plus averting better than efficient transactions.

How to Get Started with E-Invoicing

1. Choosing E-Invoicing Software

Selecting the right platform is key for a solopreneur; they should consider Assist e-Invoice for cost-effectiveness, which is PEPPOL-ready and compliant with the e-invoicing regulations of Malaysia while being easy to use.

2: Register with the Tax Authorities

Registering with the tax authorities is necessary depending upon different local regulations to provide e-invoices. In Malaysia, LHDN implements e-invoicing in phases, so it is important to stay updated with the latest information so you don’t fall behind.

3. Set Up Your Digital Invoicing System

After selecting the e-invoicing platform, create your account with necessary business details and invoice templates. All invoices provided may comply with several regulations.

4. Train Yourself and Clients

If you are not experienced with e-invoicing, invest some time to understand the system. Educate your clients on the transition for smooth flowing. Most platforms provide tutorials and support.

5. Automation and Monitoring of Your Invoices

You could automatically schedule invoices for your repeated clients, which will keep your invoices tracked in real-time for timely payments. Most e-invoicing software provides updates and notifications.

Common Challenges and How to Overcome Them

1. Resistance to Change

Transitioning from traditional invoicing to digital can feel overwhelming. However, the long-term benefits outweigh initial concerns. Choose a user-friendly platform and seek support if needed.

2. Technical Issues

Issues like software glitches or poor internet connectivity can arise. Select a reliable e-invoicing provider with strong customer support and keep your software updated.

3. Client Adaptation

Some clients may be unfamiliar with e-invoicing. Provide guidance and highlight benefits such as faster processing and easier payments to encourage adoption.

Future of E-Invoicing for Solopreneurs

E-invoicing is very much becoming a global standard; this is being driven by governments wanting to enhance tax compliance and reduce fraud. The advances in automation and AI-driven solutions will only serve to streamline invoicing processes further. So, solopreneurs who adopt e-invoicing early will have gained a competitive edge, save time, and enhance cash flow management.

Conclusion

E-invoicing is already considered mandatory—not just optional for solopreneurs. The efficiency, cost savings, and compliance benefits make it, all in all, a smart investment. By the means of right software procurement, registering with the tax authorities, and educating clients, digital invoicing can be a set transition.

✨ Simplify Your Invoicing with Assist E-Invoice Software!

Tired of juggling paperwork, tax issues, and payment delays? Assist E-Invoice Software streamlines your invoicing process—automated, compliant, and most importantly, affordable!

💼 Why Choose Assist?

💲 Affordable – Enjoy top-tier invoicing without breaking the bank.

⚙️ Automated & Accurate – Reduce manual errors and save valuable time.

📜 Real-Time Tax Compliance – Stay on top of regulations effortlessly.

🚀 Quicker Payments – Speed up your invoicing and get paid faster.

💥 Make your invoicing smarter, simpler, and more efficient today!

Frequently Asked Questions (FAQ)

What is e-invoicing?

E-invoicing refers to the electronic exchange of invoice documents between businesses and customers. Instead of printing and mailing paper invoices, everything is done digitally. This process makes invoicing more efficient, accurate, and eco-friendly.

Is e-invoicing mandatory for solopreneurs in Malaysia?

Yes, e-invoicing is mandatory for certain businesses in Malaysia, as implemented by the Lembaga Hasil Dalam Negeri (LHDN). However, it is being phased in, so it’s essential to stay informed about your specific requirements and deadlines.

What are the benefits of e-invoicing for solopreneurs?

- Efficiency: Automates invoicing, reducing the time spent on manual tasks.

- Faster payments: Enables instant invoice delivery and payment processing through integrated payment gateways.

- Cost savings: Eliminates costs related to paper, postage, and storage.

- Compliance: Reduces errors and ensures tax compliance, helping you avoid penalties.

- Environmental impact: Less paper waste, contributing to a greener business.

How do I choose the best e-invoicing software?

When selecting software, look for:

- Cost-effectiveness: Choose a platform that fits your budget.

- Compliance: Ensure the software meets your local regulations (e.g., PEPPOL-ready for Malaysia).

- Ease of use: It should be simple to set up and use, even if you’re not tech-savvy.

- Customer support: A responsive support team can help with any issues that arise.

How do I start using e-invoicing?

- Choose software: Select a platform like Assist e-Invoice, which is PEPPOL-compliant and cost-effective.

- Register with tax authorities: Depending on your country, registration may be required.

- Set up your invoicing system: Input business details, set up invoice templates, and ensure compliance.

- Educate yourself and clients: Familiarize yourself with the process and train clients to ensure a smooth transition.

Will e-invoicing software integrate with my current systems?

Most modern e-invoicing solutions integrate with popular accounting software like QuickBooks, Xero, or MYOB, allowing seamless syncing of financial data. Check the software’s integrations before making a decision.

Recent Comments