In today’s fast-paced digital economy, businesses seek ways to improve efficiency. One such innovation is electronic invoicing (e-invoicing). In Malaysia, the government encourages its adoption to streamline tax compliance. The Inland Revenue Board of Malaysia (LHDN) has introduced e-invoicing as part of its digital transformation efforts to enhance tax reporting and transparency. This initiative aligns with global best practices to improve tax collection, combat fraud, and boost productivity.

What is E-Invoicing?

E-invoicing is the digital exchange of invoice documents between businesses. Unlike traditional invoices, e-invoices are created, sent, and processed electronically. This automation reduces manual work, minimizes errors, and improves transparency.

The Malaysian government promotes e-invoicing as part of its digital agenda. This move aligns with global best practices to improve tax collection, combat fraud, and boost productivity.

Key Benefits of E-Invoicing for Malaysian Businesses

1. Simplifies Tax Compliance

Tax compliance can be complex, especially with changing regulations. E-invoicing ensures invoices are structured according to Malaysia’s tax laws. This automation reduces human errors, leading to accurate tax reporting. With real-time data transmission to tax authorities, businesses meet compliance requirements more efficiently.

2. Reduces Administrative Costs

Manual invoicing requires printing, storing, and mailing, leading to high costs. E-invoicing eliminates expenses related to paper, postage, and storage. The digital process also reduces labor costs linked to invoice processing and reconciliation.

3. Enhances Accuracy and Reduces Errors

Errors in invoicing can result in costly discrepancies. E-invoicing uses automated validation to ensure invoice details are correct. This reduces duplication, incorrect data entry, and missing information. As a result, businesses avoid disputes and payment delays.

4. Faster Processing and Payment Cycles

Traditional invoicing often leads to delayed payments. E-invoicing speeds up transactions by enabling real-time invoice exchange. Businesses send and receive invoices instantly, leading to quicker approvals and faster payments. Improved cash flow management strengthens financial stability.

5. Supports Regulatory Compliance and Audit Readiness

Malaysia’s tax authorities focus on digital tax administration. E-invoicing provides a structured digital record, making compliance easier. Businesses maintain organized records, simplifying audits and reducing penalties for non-compliance.

6. Boosts Environmental Sustainability

Paper-based invoicing contributes to deforestation and waste. Switching to e-invoicing reduces carbon footprints and supports sustainability. Digital invoicing promotes paperless operations and lowers energy consumption.

How E-Invoicing Works in Malaysia

Malaysia’s tax authorities have introduced an e-invoicing framework for compliance. Businesses must follow a standardized format set by the Inland Revenue Board of Malaysia (LHDN).

The process includes:

1. Invoice Generation

📌 Businesses create digital invoices using approved platforms.

2. Invoice Submission

📌 The invoice is electronically sent to the recipient and tax authorities.

3. Validation and Approval

📌 The system verifies the invoice format and tax details.

4. Record Keeping

📌 Digital records are maintained for tax reporting and audits.

With this system, Malaysia aims to improve tax transparency, prevent evasion, and boost economic growth.

The Role of Technology in E-Invoicing Adoption

Fintech advancements make e-invoicing adoption easier. Cloud-based accounting software and automation tools integrate with e-invoicing platforms. These technologies enable businesses to automate processing, track payments, and generate real-time reports.

Small and medium enterprises (SMEs) benefit from cloud-based e-invoicing solutions. These platforms offer cost-effective, scalable options. With user-friendly features, businesses transition smoothly from traditional invoicing.

Challenges and Solutions for E-Invoicing Implementation

Despite its benefits, adopting e-invoicing presents challenges. Businesses may face implementation costs, system integration issues, and resistance to change. However, these obstacles can be addressed with proper planning.

✅ Implementation Costs – Initial investments are required, but long-term savings outweigh costs. Government incentives may help businesses transition smoothly.

✅ Integration with Existing Systems – Choosing an e-invoicing platform that works with existing accounting systems is crucial.

✅ Training and Awareness – Educating employees on e-invoicing benefits ensures a smooth transition.

Conclusion

E-invoicing is transforming tax compliance in Malaysia. By embracing digital invoicing, businesses can streamline operations, reduce costs, and meet regulatory requirements. With the government pushing for digitalization, adopting e-invoicing is essential for staying competitive.

The transition simplifies tax compliance while improving efficiency, accuracy, and sustainability. Businesses that implement e-invoicing early gain a competitive advantage in Malaysia’s digital economy.

🚀 Say Goodbye to Invoicing Hassles with Assist E-Invoice Software!

Still dealing with manual errors, tax confusion, and payment delays? It’s time to upgrade! Assist E-Invoice Software makes invoicing effortless, accurate, and fully compliant.

✨ Why Choose Assist?

✅ 100% Automation – No more manual errors or wasted time.

✅ Instant Tax Compliance – Stay ahead with real-time accuracy.

✅ Faster Payments – Get paid quicker with seamless digital invoicing.

✅ Affordable & Cost-Effective – Get premium features without breaking the bank.

💡 Smart invoicing doesn’t have to be expensive—upgrade today!

Frequently Asked Questions (FAQs)

What is e-invoicing, and how does it work in Malaysia?

E-invoicing is the digital exchange of invoices between businesses and tax authorities. In Malaysia, the Inland Revenue Board of Malaysia(LHDN) has introduced an e-invoicing system to improve tax compliance. Businesses generate digital invoices, which are automatically submitted to LHDN for validation before reaching recipients.

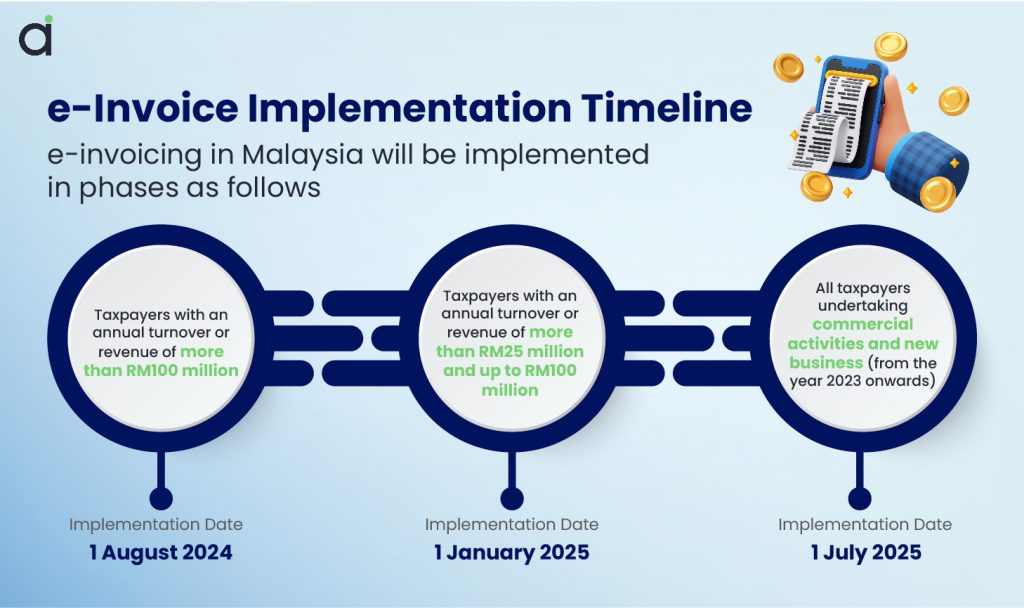

Who is required to implement e-invoicing in Malaysia?

The Malaysian government is gradually mandating e-invoicing for businesses. Large corporations may need to comply first, followed by SMEs. Companies should stay updated with LHDN’s guidelines to determine their compliance timeline.

What are the key benefits of e-invoicing for businesses?

E-invoicing simplifies tax compliance, reduces administrative costs, minimizes errors, speeds up payment processing, improves financial transparency, and enhances audit readiness. It also helps businesses transition to a paperless and sustainable operation.

How can businesses transition to e-invoicing smoothly?

To implement e-invoicing successfully, businesses should:

- Use LHDN-approved e-invoicing platforms

- Integrate the system with existing accounting software

- Train employees on digital invoicing

- Keep records updated for compliance and audit purposes

Is e-invoicing secure and legally recognized?

Yes, e-invoicing is legally recognized in Malaysia and ensures a secure, tamper-proof system. It uses encryption and validation processes to protect business data, reducing risks of fraud and tax evasion.

What happens if a business fails to comply with e-invoicing regulations?

Non-compliance may result in penalties or audits from LHDN. Businesses should ensure timely adoption of e-invoicing to avoid legal or financial risks. Staying compliant also improves business credibility and tax efficiency.

Recent Comments