The world of business is evolving faster than ever, and Malaysia is embracing this change head-on. With the government’s new e-invoicing mandate, companies of all sizes are about to experience a major shift in how they manage their finances, taxes, and business operations. This mandate, enforced by the Inland Revenue Board of Malaysia (LHDN), aims to streamline the tax system, improve compliance, and make business operations more efficient. But what does this mean for Small and Medium Enterprises (SMEs) and larger enterprises? Let’s break it down in a way that’s both exciting and practical!

What’s E-Invoicing All About?

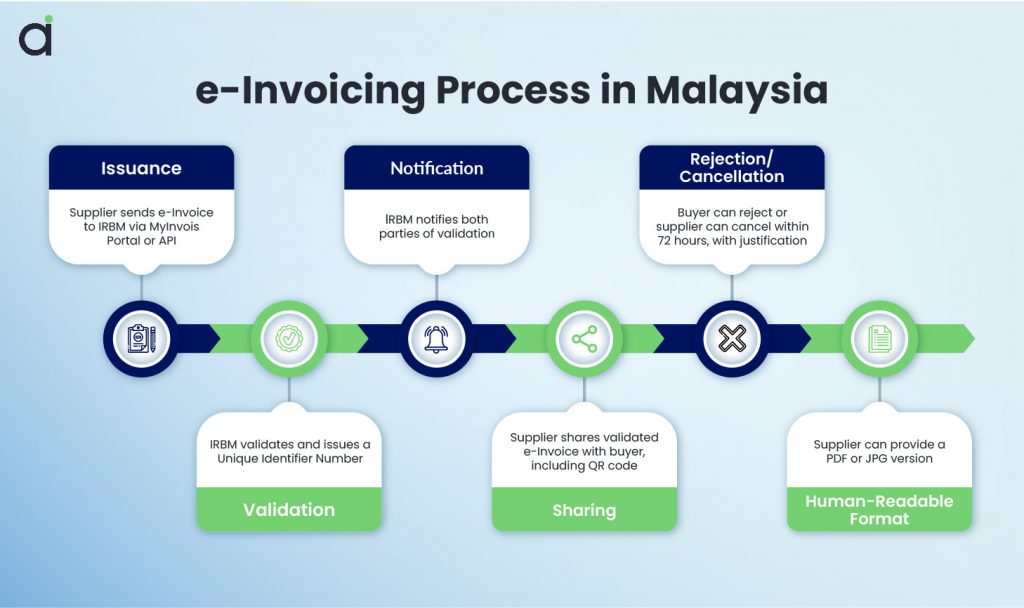

At its core, e-invoicing is about replacing traditional paper invoices with digital ones. Simple, right? But it’s so much more than that. It’s about streamlining business processes, eliminating paperwork, reducing errors, and – here’s the kicker – making tax reporting a whole lot easier. It’s all part of Malaysia’s effort to modernize and align with global trends.

The Government’s New Mandate

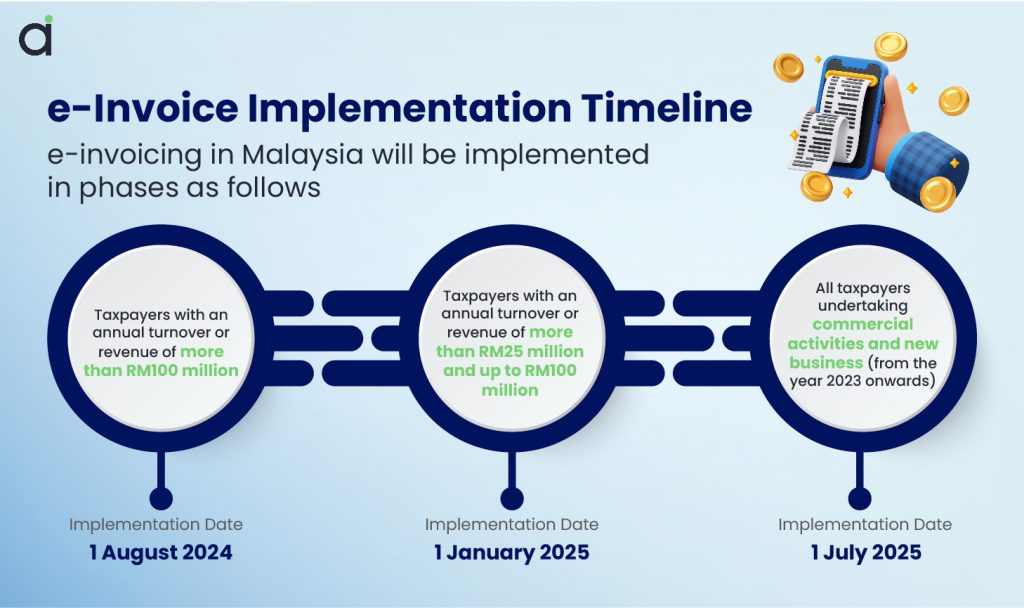

Starting In August 2024, the Malaysian government introduced a phased implementation of mandatory e-invoicing, aiming to modernize the tax system and enhance compliance. The rollout is structured as follows:

- August 1, 2024: Mandatory e-invoicing commenced for taxpayers with an annual turnover exceeding RM100 million.

- January 1, 2025: The mandate expanded to include taxpayers with an annual turnover between RM25 million and RM100 million.

- July 1, 2025: The mandate will cover all remaining taxpayers, regardless of turnover.

This phased approach allows businesses to adapt to the new system gradually, ensuring a smoother transition and greater compliance across the board.

How Does It Impact SMEs?

For small businesses, this could feel like a big leap forward—or a hurdle to overcome. Let’s take a look at both sides of the coin.

From Bright Side:

1. Faster Operations

Forget the headache of manual invoicing. E-invoicing cuts down on time and human error, allowing SMEs to focus on what really matters—growing their business.

2. Better Cash Flow Control

E-invoices sync seamlessly with accounting systems, making it easier for SMEs to track payments and manage cash flow in real-time.

3. Compliance Made Easy

With all transactions automatically reported to the government, staying tax-compliant has never been simpler, reducing the risk of costly fines.

Challenges to Consider:

1. Initial Costs

Transitioning to e-invoicing can be costly for small businesses, from software upgrades to training staff. However, the long-term savings on paper and labor may outweigh these initial expenses.

2. Tech Learning Curve

For businesses that aren’t tech-savvy, the shift could be overwhelming. But with the right support and training, the transition can be smoother.

3. Data Privacy Worries

With real-time data sharing with the government, there may be some concerns about security, but with the right cybersecurity measures in place, these risks can be minimized.

What About Larger Enterprises?

Larger companies have the resources and infrastructure to adapt to the e-invoicing mandate more easily, but that doesn’t mean they’re immune to challenges.

Perks for Big Players:

1. Major Cost Savings

For large enterprises, the savings from eliminating paper, postage, and manual labor can be significant. Plus, faster invoicing means faster payments.

2. Data-Driven Decisions

E-invoices provide real-time data on transactions, allowing companies to dive deep into analytics and make smarter, data-driven decisions.

3. Enhanced Transparency

E-invoicing ensures all financial transactions are transparent and compliant, strengthening relationships with tax authorities and customers alike.

The Not-So-Fun Side:

1. Tech Integration

Integrating e-invoicing with existing enterprise systems can be a headache. Companies need to invest in tech support to make sure everything runs smoothly.

2. Staying Ahead of Regulations

Tax laws are always evolving, and large businesses will need to stay on top of changes to ensure compliance.

3. Privacy Concerns

With the government accessing real-time financial data, privacy and data protection become even more important.

E-Invoicing Vs. Traditional Paper Invoicing

Feature | Traditional Invoicing | E-Invoicing |

Processing Time | Slow (manual handling) | Fast (automated processing) |

Cost | High (printing, postage, storage) | Low (paperless, automated) |

Error Risk | High (manual data entry mistakes) | Low (automation reduces errors) |

Payment Speed | Delayed (longer approval process) | Faster (real-time transactions) |

Compliance | Manual tax reporting | Automated tax compliance (e.g., MyInvois) |

Security | Risk of lost invoices or fraud | Secure digital records with encryption |

Scalability | Difficult to scale | Easily scalable for growing businesses |

Tracking & Reporting | Limited | Real-time insights & audit trails |

Why This Matters for Malaysia

Beyond the benefits for businesses, e-invoicing is a win for the country as a whole. It will streamline Malaysia’s tax system, making it more efficient and reducing opportunities for tax evasion. Plus, it aligns Malaysia with international digital standards, positioning the country as a leader in the global digital economy.

In Conclusion: A New Era for Malaysian Business

Malaysia e-invoicing mandate is more than just a regulatory change—it’s an opportunity for businesses to future-proof their operations. While the transition may be challenging for some, the rewards are clear: increased efficiency, better financial management, and enhanced compliance with tax laws. The businesses that embrace this change early will be the ones reaping the benefits of a more streamlined, digital future.

🌟 Ready to Revolutionize Your Invoicing?

🔹 Try Assist.biz E-Invoice – The smart, easy solution for seamless invoice management!

✔️ LHDN-Compliant

✔️ Smooth Integration

✔️ Fully Automated E-Invoicing

Click here to read more FAQs on Malaysia e-invoice.

FAQs: Malaysia's E-Invoicing Mandate

What is e-invoicing?

E-invoicing refers to the electronic generation, transmission, and storage of invoices. It replaces paper invoices and integrates directly with accounting systems, enabling smoother, faster, and more accurate invoicing and tax reporting.

Why has the Malaysian government mandated e-invoicing?

The government has implemented e-invoicing to increase business efficiency, improve tax compliance, reduce fraud, and streamline the overall invoicing process. It’s part of Malaysia’s effort to align with global digital standards and build a more transparent and efficient tax system.

Who is affected by the e-invoicing mandate?

The mandate applies to all businesses in Malaysia, both small and large, that engage in taxable transactions. This includes SMEs as well as large enterprises.

How will e-invoicing affect businesses’ relationship with tax authorities?

E-invoicing will likely improve businesses’ relationships with tax authorities by ensuring more accurate and timely tax filings. The real-time reporting also reduces the likelihood of discrepancies or tax evasion.

Will e-invoicing be mandatory for all businesses in Malaysia?

Yes, the mandate will cover all businesses in Malaysia by July 1, 2025. It will start with larger businesses, gradually including those with annual turnovers between RM25 million and RM100 million by January 2025, and finally, all remaining businesses by July 2025.

Can businesses still issue paper invoices if they prefer?

No, paper invoices will no longer be valid once the e-invoicing mandate takes effect. Businesses must fully transition to digital invoicing to remain compliant with the law.

Recent Comments