E-invoicing is becoming a mandatory requirement in Malaysia as part of the government’s digital transformation efforts. The MyInvois Portal is the official platform designed by Lembaga Hasil Dalam Negeri (LHDN) to facilitate electronic invoicing for businesses. This guide will walk you through the registration process and how to use the MyInvois Portal effectively.

What is MyInvois Portal?

The MyInvois Portal is an online platform developed by LHDN Malaysia to help businesses generate, issue, and manage electronic invoices (e-invoices) in compliance with national tax regulations. It ensures seamless integration with government tax systems, improving efficiency and transparency in transactions.

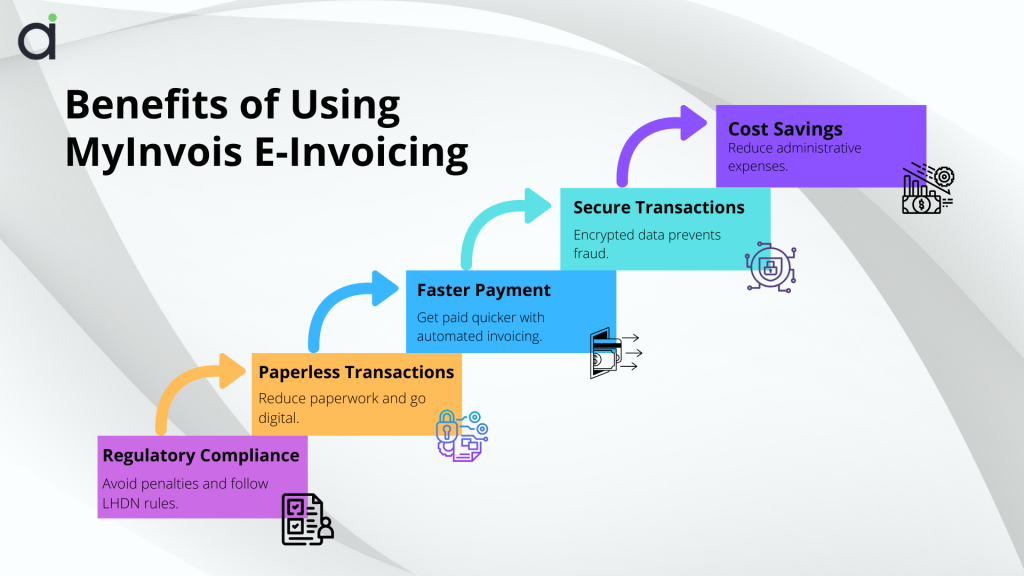

Benefits of Using MyInvois Portal

✅ Compliance with LHDN Regulations –Ensures adherence to Malaysia’s e-invoicing rules, helping businesses avoid penalties.

✅ Reduced Paperwork –Supports a paperless approach, boosting efficiency.

✅ Faster Payment Processing – Automate invoicing and reduce payment delays.

✅ Secure Transactions –Safeguards invoice data through encrypted transmissions.

✅ Cost Savings –Lowers administrative expenses related to invoicing.

Who Needs to Register for MyInvois?

The Malaysian government is rolling out mandatory e-invoicing requirements in phases. Registration is required for:

📌 Large corporations exceeding the revenue threshold set by LHDN.

📌 Small and Medium Enterprises (SMEs) planning to switch to e-invoicing.

📌 Businesses involved in B2B, B2G, and cross-border transactions.

How to Register for MyInvois Portal

Step 1: Access the MyTax Portal

- Visit the MyTax Portal.

- Log in using your existing MyTax credentials.

- If you do not have an account, follow the instructions to register for a MyTax login.

Step 2: Apply for a User Role

- Navigate to the Role Application Section.

- Select ‘Company Director’ as your role.

- Submit the application for approval.

- Once approved, you can appoint a Company Representative to manage invoices on behalf of the business.

Step 3: Access the MyInvois Portal

- After approval, go to the MyInvois Portal via the MyTax dashboard.

- Use your MyTax credentials to log in.

Step 4: Set Up Business Profile

- Update company details, including:

✅ Business Registration Number

✅ Company Taxpayer Identification Number (TIN)

✅ Contact Information - Assign additional users and representatives if required.

Step 5: Configure MyInvois Settings

- In the portal, configure:

✅ Taxpayer Information (Company & Business Details)

✅ User Management (Directors & Representatives)

✅ Intermediary & ERP Integrations (if applicable)

Step 6: Begin Using MyInvois Portal

- After setup, businesses can start issuing, managing, and submitting e-invoices through the portal.

- Utilize document management features to:

✅ Submit Invoices

✅ Track Payments

✅ Modify or Cancel Invoices

How to Use the MyInvois Portal for E-Invoicing

Once registered, follow these steps to generate and manage e-invoices effectively.

Step 1: Login to MyInvois Portal

- Visit the MyInvois Portal and enter your username and password.

- Complete any security verification required.

Step 2: Set Up Your Business Profile

- Update company details under the “Business Profile” section.

- Add multiple users if needed (e.g., accountants, finance officers).

- Set permissions based on roles.

Step 3: Generate an E-Invoice

- Go to the Invoice Management Section.

- Click “Create New Invoice”.

- Enter the following details:

- Buyer’s Information (Company Name, TIN, Contact Details).

- Invoice Number (Auto-generated or manually assigned).

- Invoice Date and Due Date.

- Product/Service Description with Itemized Pricing.

- Tax Details (SST/GST if applicable).

- Payment Terms.

- Click “Submit” to generate the invoice.

Step 4: Sending the E-Invoice

- Choose the delivery method:

- Send via MyInvois Portal (direct email to the recipient).

- Download as PDFs and share manually.

- Integrate with Accounting Software (if applicable).

Step 5: Managing Invoices

- Track pending, paid, and overdue invoices from the dashboard.

- Use filters to find invoices by date, amount, or status.

- Edit or void incorrect invoices before final submission.

Step 6: Reporting and Compliance

- Access tax reports under “Reports”.

- Generate monthly and annual summaries for LHDN filing.

- Ensure compliance with e-invoicing deadlines.

Common Issues & Troubleshooting

🔹 Forgot Password – Click “Forgot Password” and follow email instructions.

🔹 Invoice Not Generating – Check required fields for missing details and ensure the correct TIN number for buyers.

🔹 Approval Delays – Contact LHDN support if verification exceeds 7 working days.

Conclusion

Why Register Early?

The MyInvois Portal plays a key role in Malaysia’s digital transformation, simplifying e-invoicing while ensuring compliance, efficiency, and security. Registering early helps businesses avoid penalties and transition to an automated invoicing system that improves financial management.

Business Advantages

By following this guide, you can seamlessly register, set up, and use MyInvois for hassle-free e-invoicing. Staying compliant with LHDN regulations not only simplifies tax reporting but also improves business credibility and cash flow.

🚀 Looking for a Smarter E-Invoice Solution?

🔹 Try Assist.biz E-Invoice – The smart, hassle-free solution for managing your invoices!

✅ LHDN-Compliant

✅ Seamless Integration

✅ Automated E-Invoicing

Frequently Asked Questions

Who needs to register for the MyInvois Portal?

Businesses in Malaysia, including large corporations, SMEs, and those involved in B2B, B2G, or cross-border transactions, must register as part of the phased e-invoicing implementation by LHDN.

How long does it take to get approval after registering on MyInvois?

The approval process typically takes a few working days. If it exceeds seven days, businesses can contact LHDN for assistance.

Can I integrate MyInvois with my existing accounting software?

Yes, MyInvois supports integration with accounting and ERP systems, allowing businesses to automate e-invoicing processes for efficiency.

What should I do if I forget my MyInvois login credentials?

Use the “Forgot Password” option on the MyInvois login page to reset your credentials via email verification.

How do I ensure my e-invoices comply with LHDN regulations?

Ensure all required details, such as Tax Identification Number (TIN), invoice number, and tax information, are accurately included. Regularly check for updates from LHDN to stay compliant.

What are the benefits of using Assist.biz E-Invoice with MyInvois?

Assist.biz E-Invoice simplifies compliance with LHDN regulations by offering automation, secure transactions, and seamless integration, making invoice management faster and more efficient.

Recent Comments