In today’s fast-paced business world, managing finances efficiently is crucial for maintaining stability and growth. Two essential components of financial management are Accounts Payable (AP) and Accounts Receivable (AR).

These processes track the money flowing out and into your business, ensuring smooth operations and cash flow. Let’s dive deeper into their roles and how leveraging automation can optimize these processes.

Read more Bookkeeping Automation

Understanding Account Payable and Account Receivable

Accounts payable (AP) and accounts receivable (AR) are essential components of a company’s financial management. While accounts payable involves obligations to vendors or suppliers, accounts receivable encompasses the money owed to a business by its customers. Together, they serve as pillars of effective cash flow management, ensuring the smooth functioning of operations.

What is Account Payable (AP)?

Definition and Purpose

Accounts payable refers to the short-term liabilities a company owes to its suppliers or vendors for goods and services received but not yet paid for. These are recorded as liabilities on the balance sheet and signify the company’s responsibility to settle debts within a specified period.

Significance

Efficient management of AP ensures a company maintains good relationships with suppliers while optimizing cash flow. It also helps avoid late fees or disruptions in operations.

Examples

- Payment for office supplies purchased on credit.

- Settling a monthly utility bill that is yet to be paid.

What is Account Receivable (AR)?

Definition and Role

Accounts receivable represents the money a company is owed by customers for products or services provided on credit. It is recorded as an asset on the balance sheet because it reflects expected future cash inflows.

Importance

Effective AR management ensures timely cash flow, which is critical for meeting operational expenses and reinvesting in growth.

Examples

- A client purchasing software on a 30-day credit term.

- A business invoicing a customer for construction services provided.

The Role of Accounts Payable in Business Operations

Accounts payable is more than just tracking debts; it plays a crucial role in maintaining supplier trust and ensuring operational continuity.

Accounts Payable Process Flow

- Receiving Supplier Invoices

Ensure invoices are verified for accuracy and completeness. - Approval Process

Obtain necessary approvals before payment is made. - Payment Scheduling

Plan payments to align with cash flow while adhering to supplier deadlines. - Recording Transactions

Update the accounting system to reflect payments and outstanding amounts.

Common Challenges in Managing Accounts Payable

- Invoice Discrepancies: Mismatched invoices leading to delays.

- Late Payments: Missed deadlines affecting vendor relationships.

- Manual Errors: Data entry mistakes increasing inefficiency.

Best Practices

- Use AP automation tools to reduce errors.

- Establish clear payment schedules to avoid missed deadlines.

The Importance of Accounts Receivable for Business Growth

Accounts receivable directly influences a company’s liquidity. Timely collection ensures that businesses have adequate cash to cover expenses, invest in growth, and improve profitability.

Accounts Receivable Workflow

- Generating Invoices

Ensure invoices are clear, detailed, and promptly sent to customers. - Tracking Payments

Use software to monitor incoming payments and overdue accounts. - Collection Follow-Ups

Implement follow-up strategies to recover overdue payments.

How to Reduce AR Collection Delays

- Clear Payment Terms: Clearly define due dates and penalties for late payments.

- Incentivize Early Payments: Offer discounts for early settlements.

- Regular Communication: Follow up consistently with customers about overdue payments.

Key Differences Between Accounts Payable and Accounts Receivable

| Aspect | Accounts Payable | Accounts Receivable |

| Definition | Money owed by a business to suppliers. | Money owed to a business by customers. |

| Balance Sheet Placement | Liability | Asset |

| Role | Manages outgoing payments. | Manages incoming cash. |

Best Practices for Managing Accounts Payable and Receivable

Efficient management of both AP and AR can enhance financial stability.

Leveraging Technology

- Automation: Use tools like QuickBooks or Xero for tracking and processing.

- Reporting: Generate real-time reports for better decision-making.

Building Relationships

- Communicate effectively with both suppliers and customers to foster trust.

The Future of Accounts Payable and Receivable

The financial landscape is evolving with the integration of technology like artificial intelligence and blockchain. These innovations are streamlining processes, enhancing accuracy, and reducing manual intervention.

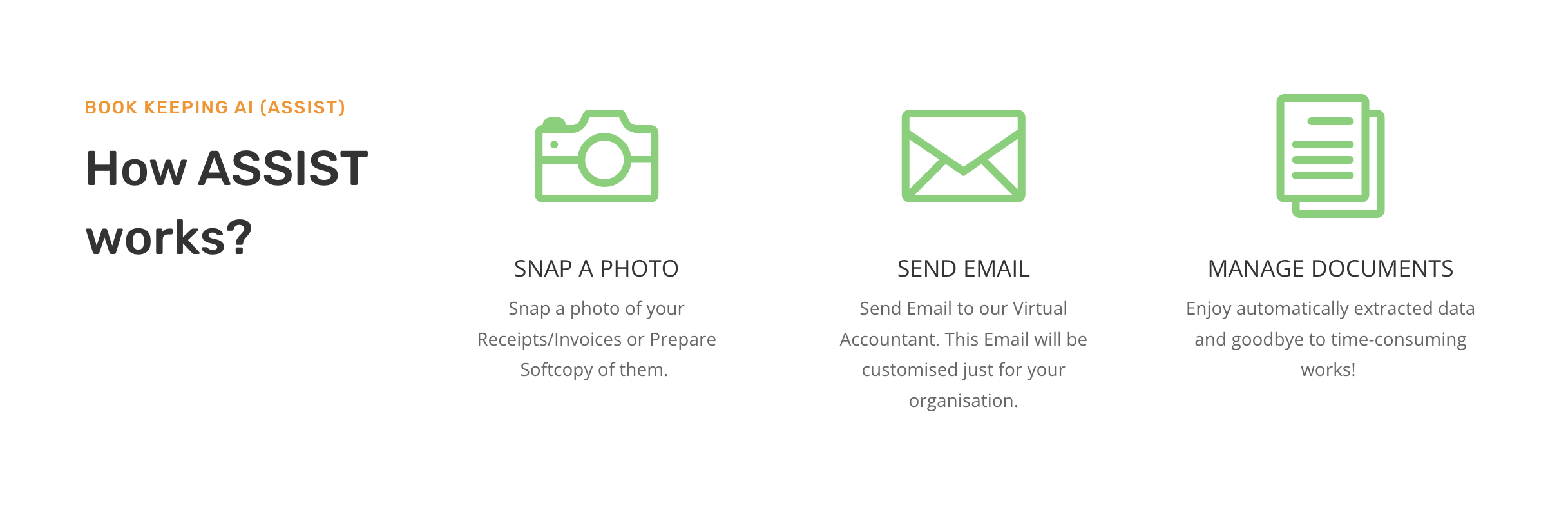

One standout solution is Assist, a powerful software designed to save time by automatically categorizing Accounts Payable and Accounts Receivable. Assist quickly scans and extracts data from invoices or receipts, seamlessly integrating it with accounting software such as Xero and QuickBooks within seconds. Trusted by over 10,000 users worldwide, Assist has built a strong reputation across marketplaces for its efficiency and reliability

Read more Efficient Web-Based Document Management System

Revolutionizing AP and AR with Automated Solutions from Assist.Biz

Managing invoices and receipts manually can be time-consuming and prone to errors. To address these challenges, Assist, an advanced data capture tool, offers a powerful solution to automate and streamline these processes.

How Assist Automates Data Capture

- Efficient Invoice and Receipt Scanning

Assist uses OCR (Optical Character Recognition) technology to digitize invoices and receipts accurately. - Automatic Categorization

Once captured, Assist intelligently categorizes transactions into Accounts Payable or Accounts Receivable, eliminating manual sorting. - Seamless Integration with Accounting Systems

Assist integrates with leading accounting software like QuickBooks, Xero, and SAP, ensuring that all data flows seamlessly into your financial systems. - Real-Time Tracking

Gain instant visibility into your AP and AR statuses through real-time dashboards.

Benefits of Automating AP and AR with Assist

-

- Time Savings: Eliminate hours of manual data entry.

- Improved Accuracy: Reduce errors caused by manual input.

- Faster Reconciliation: Streamlined categorization speeds up financial reconciliation.

- Enhanced Compliance: Maintain a clear audit trail for all transactions.

- Cash Flow Insights: Gain actionable insights to make informed decisions.

- Free lifetime trial available!

By adopting Assist, businesses can focus on growth while leaving the complexities of invoice and receipt management to a trusted, automated system.

Here’s one testimony from an Assist user on how it saved their company time by automating AP and AR categorization.

Conclusion

Accounts payable and accounts receivable are vital for smooth financial management, ensuring the proper flow of funds in and out of a business. Tools like Assist simplify these processes by automatically scanning, capturing, and categorizing invoices and receipts in seconds—whether uploaded, captured, or sent via email. By leveraging Assist, businesses can save time, reduce errors, and ensure seamless AP and AR management, paving the way for stability and growth.

Don’t let manual tasks slow you down! Sign up for Assist’s lifetime free trial and automate your invoices and receipts today.

FAQs About Accounts Payable and Accounts Receivable

- What is the main difference between AP and AR?

Accounts payable refers to money a business owes to its suppliers, while accounts receivable is money owed to the business by its customers. - How can I manage accounts payable effectively?

Use accounting software, automate processes, and maintain a clear payment schedule to avoid late fees and build supplier trust. - Why is managing accounts receivable important?

Effective AR management ensures steady cash flow, which is essential for covering operational costs and investing in growth. - What tools can help with AP and AR management?

Software like QuickBooks, FreshBooks, and Xero can automate and streamline AP and AR workflows. - How do late payments impact a business?

Late payments in AP can harm supplier relationships, while delays in AR can strain cash flow and affect operations.

Recent Comments